Table of Contents

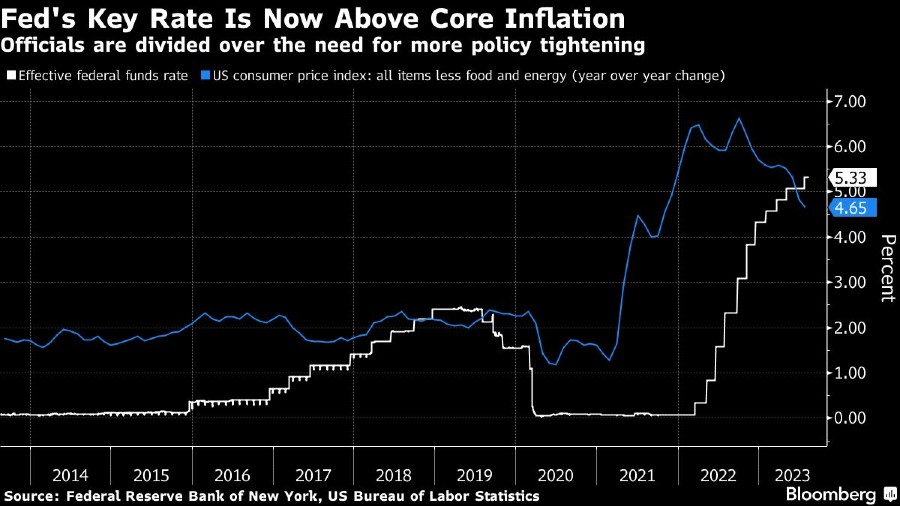

- Traders Trim Bets on 2024 Fed-Rate Cuts After Inflation Report - Bloomberg

- Market Outlook 2024: Fed Unlikely to Cut Rates by 75 bps Marcellus ...

- US Dollar Advances as Fed Pause Unlikely. Forecast as of 14.11.2024 ...

- US Federal Reserve holds rates again over ‘elevated’ inflation, sees 3 ...

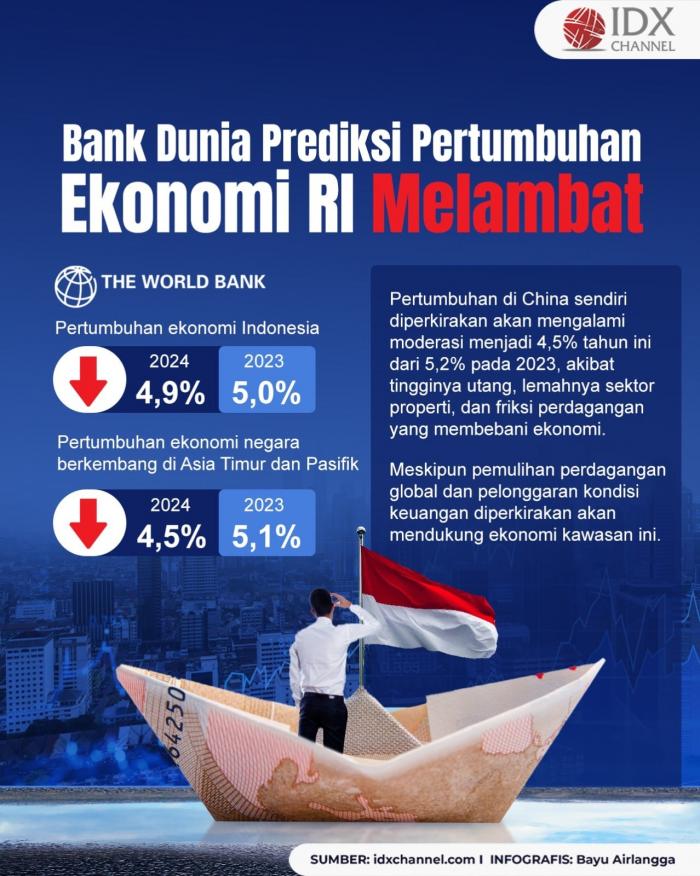

- Bank Dunia Prediksi Pertumbuhan Ekonomi RI Melambat Jadi 4,9 Persen ...

- Fed Holds Interest Rates Steady—And Signals Just One Cut In 2024

- Investment bank bullish on Fed rate cuts; inflation concerns linger ...

- Fed rate cuts to remain in view for 2024, even as rate-setters shift ...

- Forecast Fed Rate 2024 - Esme Ofelia

- Ada Risiko 'Hard Landing', The Fed akan Pangkas Bunga Maret 2024 - Market

Background: The Current Economic Climate

The Interest Rate Decision: What It Means

Implications for the Housing Market

The Fed's decision to keep interest rates unchanged is also likely to have a positive impact on the housing market. With interest rates on mortgages remaining low, homebuyers will continue to have access to affordable financing options, which could help to support demand for housing. This, in turn, could help to boost the construction industry and support economic growth.

What's Next for the Economy?

Looking ahead, the Fed's decision to keep interest rates steady suggests that it is taking a wait-and-see approach to monetary policy. The central bank will continue to monitor economic developments, including inflation, employment, and GDP growth, and will adjust interest rates as needed to support the economy. In the short term, the decision is likely to have a positive impact on the stock market and the housing market. However, the longer-term implications of the decision will depend on a range of factors, including the outcome of the US presidential election, the trajectory of global trade tensions, and the performance of the US economy. In conclusion, the Federal Reserve's decision to keep interest rates unchanged in June 2024 reflects its cautious approach to monetary policy. While the decision is likely to have a positive impact on the stock market and the housing market, it also means that savers will continue to earn low returns on their deposits. As the economy continues to evolve, the Fed will need to balance its dual mandate of promoting maximum employment and price stability, and its decisions will have significant implications for the economy and financial markets.Keywords: Federal Reserve, interest rates, economy, monetary policy, inflation, employment, GDP growth, housing market, stock market, savers, borrowers, investors.